What is Multilateral Netting?

When we’re approached about multilateral netting, it usually comes with some statement about it being “the new cash pooling”. Netting’s role in reducing cash-in-transit is one of the main reasons why treasurers start looking at netting systems. It offers high value across the board. Thus, multilateral netting is transformative for intra-firm trade, providing a plethora of organizational advantages both for cash managers and for treasury in general.

What is netting?

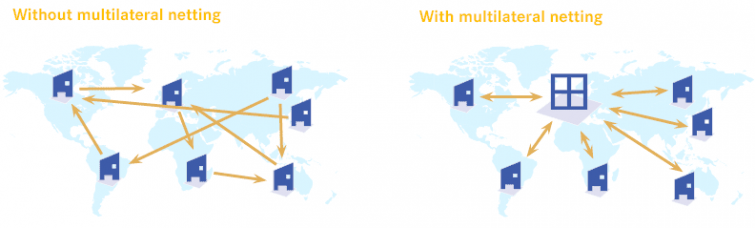

One part accounting practice, one part treasury management, netting is at its most basic the off-setting of payables against receivables between multiple group companies. Under multilateral netting, the resulting payments due are paid to the netting center from group companies, and monies owed are paid from the netting center to group companies.

Usually, netting is coupled with a payment structure that defines when and in which currency each payment is made. This means that a payment will be made to or from the netting center on a precise date, and often (though not always) in the currency of the subsidiary. This structure removes a lot of the guesswork about when a payment will come in and when another will go out, allowing more accurate planning of accounts.

Related Reading: Netting: An Immersive Guide to Global Reconciliation

Dealing with disagreements

Classically netting systems have used reconciliation processes favoring either accounts payable (AP) or accounts receivable (AR). These systems put either the payer or the payee in charge of establishing the legitimacy of a trade. They are simple and efficient but tend to open up the potential for devious subsidiaries to “cheat” the system by either (in the case of payments driven netting) not entering invoices, or (in the case of receivables driven) by entering agreements that haven’t been agreed upon and forcing a deal. This can obfuscate problems within the intra-firm trade structure, and potentially hurt the corporate group.

Today most modern multilateral netting systems feature AR/AP matching and dispute management systems – or, as we call it, “agreement driven netting”. These systems allow the upload of both AP and AR statements which are then matched against each other and agreements automatically processed. Disagreements get put into a dispute process whose framework is definable by the managing parties. Often this entails both parties making their claim to an arbitrator further up the chain of command.

The key value of this approach is engagement. A netting process only works if involved subsidiaries agree to use it. Under an agreement based system, it is in both parties interest to engage – so as to prevent one party from taking advantage of the other – no one is going to walk away from the process, and all deals get recorded.

Multilateral Netting and Its Role in Treasury

Treasurers look into netting for its role in reducing cash in transit because it limits how much cash is passed around. Subsequently, it leads to a reduction in the number of needed accounts, and the downtime the money is held at banks. But what often gets overlooked is the structure it brings intra-firm trade.

You likely have a “must pay the invoice by” due date which defines when companies must pay all open invoices by. However, what happens if companies don’t pay by the correct date? Or don’t pay at all? This disrupts cash flow.

By structuring trade and defining payment dates, the netting process simplifies due dates and terms. It gives subsidiaries the knowledge of when money is coming in, going out, and what terms are tied to it. This allows them to better predict the cash they will need available.

Meanwhile, since an agreement driven system encourages all parties to enter their side of deals into the system, treasury gets a view of which subsidiaries are problematic – say if one subsidiary regularly misses payments. As a result, this increased visibility allows central treasury to predict any required financing and makes sure that no group company finds itself lacking liquidity due to being on the losing end of a deal gone sour.

In short, multilateral netting enforces payment rules, reduces the uncertainties involved in these scenarios, and gives structure to your intra-firm trade process – providing smoother and more efficient deals.

Tangible Benefits of Multilateral Netting

Of course, that’s not all. While there is a such a wealth of advantages, a full discussion of them would probably take the rest of your afternoon. In short:

Netting forces you to implement organizational controls that:

- reduces intercompany cash flows to one per month per subsidiary.

- streamlines reconciliation between group companies.

- enforces a strict payment schedule that’s easy to follow.

- quickly resolves mismatches on Intercompany bookings.

- makes quarterly balance reconciliation fast and efficient.

For cash managers, netting:

- lets you integrate local cash pools and non-pooled accounts into a global structure.

- ensures cash visibility of group liquidity with banks

- optimizes the use of funds within the group

- ensures effective payment processes for group companies

- reduces the number of IC funds transfer payments

- centralizes FX risk

For intra-firm financing, netting:

- standardizes inter-company financing procedures.

- consolidates bank borrowing under prime terms negotiated with banks that have key relationships with the central treasury.

- brings exceptional visibility to intra-firm trade requirements, enabling central treasury to recognize and provide refinancing to companies whose intra-firm trades have left them short on liquidity.

- reduces cross-border transfer charges.

- enforces payment rules.

Want to learn more about our powerful treasury solutions? Time to discover Coupa Treasury.